Moving from Traditional Microfinance to Full Transformation for Women and Society

Microfinance is a powerful tool for unleashing systems change—one that we discuss often at Lebec Consulting. But it has some limitations, which means there are ways to optimize it to create an even greater impact. We recently spoke with Pon Aananth, a social entrepreneur who is striving to do just that—and we believe his story should be heard.

Microfinance Can Be a Catalyst for Economic Growth Driven by Women

Pon Aananth is working tirelessly to optimize microfinance—a tool that is greatly impactful and revolutionary in its own right. However, there’s a bridge still missing from microfinance to equality for women. Aananth’s efforts, in collaboration with others, are striving to build that bridge.

When he launched Adith Corporate Services (Adith) in 2019, it was with the intention of “[removing obstacles from] women to build a new equitable world with peace and prosperity.” That’s an eloquent way of saying that he wants to help women in emerging cities like Chennai, Tamilnadu (India) have the opportunities they want and deserve, economic freedom, and—by extension—equality. And he’s primarily working to accomplish that by ensuring women have access to more capital, training, and skills building.

Over the years, Aananth has seen firsthand the ways in which microfinance—and the system in which it exists—becomes limited, and so he began to formulate an organization whose mission is to take something great…and make it immeasurably greater. It’s rooted in the notion that there are three primary ways in which microfinance is not achieving its greatest impact, given the way that it’s currently structured:

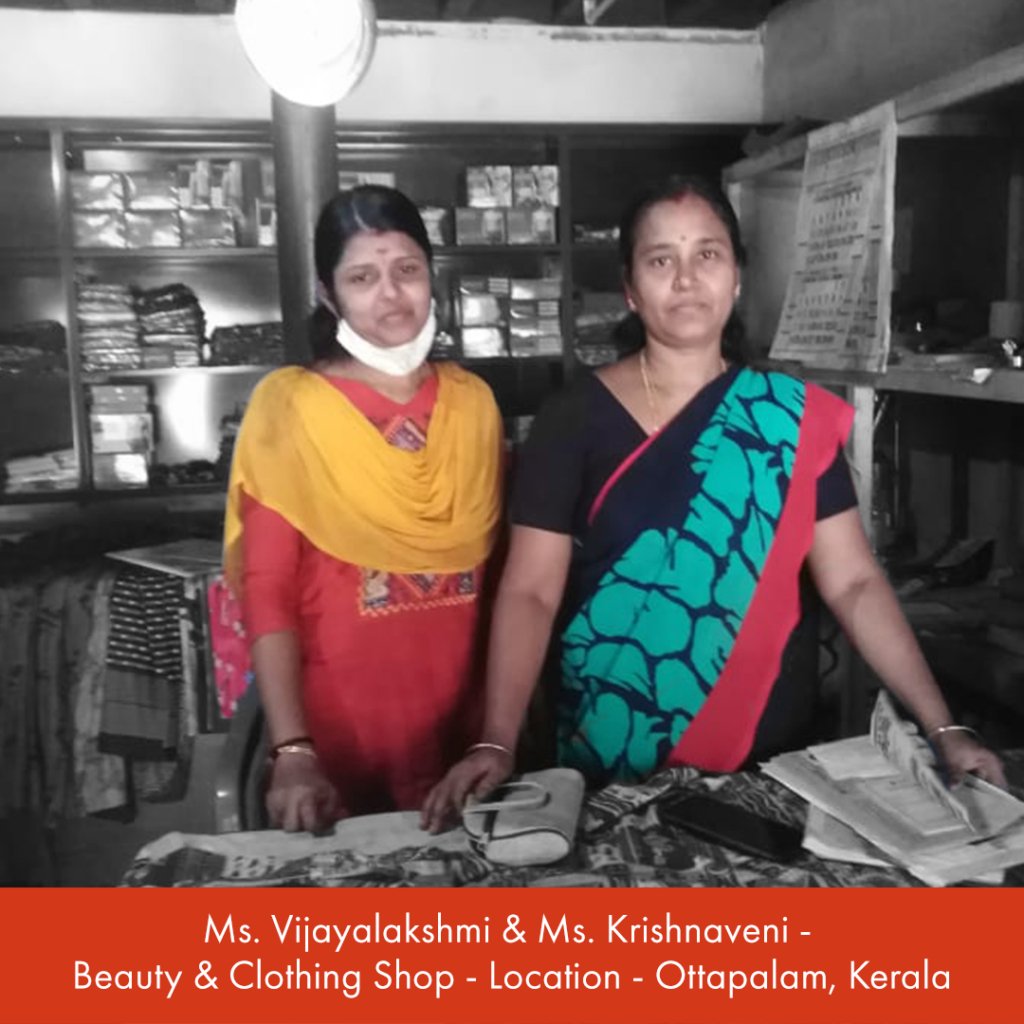

- The focus is too narrow. Women in emerging markets can sometimes get a microloan—typically $100-250, on average, in emerging markets—for specific things like gaining water access and sanitation, planting vegetables, or getting a small business off the ground. But then what? What happens after the business has a successful launch and needs more capital to grow? This is where the issue lies, in addition to the fact that in many cases, there are no loan products for women specifically. Most women who get a micro-loan to start a business do not have access to bigger pools of capital to grow. Aananth and his organization are working toward a solution that includes providing more diverse, holistic loan products that will allow these women to access more capital to address their needs—including growing their businesses—and have access to the same financial tools that allow us in the U.S. to gain wealth. As a result, they can thrive, create something on their own terms, and become key contributors to their economy.

- The available capital is inadequate. Let’s be clear: Microfinance is a powerful tool. And access to capital, in general, can be life changing. But it’s currently insufficient. What does that mean exactly? Well, in one case, it has to do with the availability of money. There is so much more demand out there than capital available for microloans. In fact, if all women who need capital to jumpstart or grow a business had it available to them, according to McKinsey, it could represent $12 trillion in additional global gross domestic product (GDP) by 2025. In another case, it has to do with the amount of money—which goes beyond microfinance and brings larger non-banking financial companies (NBFCs)—often private capital—into play. For women who have successfully grown their business to the point where they need more than microfinance—representing about 20%, in Aananth’s experience in Chennai—it’s imperative that they have access to greater amounts of capital. In these cases, the need for growth capital exceeds microloans—and instead demands 3-4 times those loan amounts. Microfinance is a great tool to jumpstart the process, but once success is proven, larger NBFCs should be brought to the table. Adith is working to put that ecosystem in place and ensure that when women are ready to take their business to the next level, the capital they need is available for them. Mainstream financial institutions are not currently prepared to take up these challenges, because this is not their primary focus today.

- It lacks an ecosystem that supports going from a pilot stage to growth and scale. As it stands, microfinance is largely about getting capital into the hands of those who need it. Period. There are few (if any) structures in place that follow up with training, business development, skill building, and bridging the digital divide that so often exists—particularly in agriculture, where farmers can’t communicate seamlessly with the businesses to which they’re selling. Adith is working to implement solutions whereby the team sits with each individual microloan borrower, understands the business dynamics of that borrower’s particular focus area, understands what that borrower is doing and how to scale their business, and determines what synergies exist. If all those elements are part of the process, it greatly increases the company’s ability to become a meaningful contributor to the economy.

For instance, a woman entrepreneur might have a very successful business idea that’s projected to turn over half a million dollars. But perhaps she doesn’t have access to a sophisticated computer or optimal accounting methods. Especially in cases like these, Aananth believes that having a dedicated business development individual assigned to every case is key. In fact, within 15 years—by the end of 2026—Adith has two specific goals: 1) Provide access to credit, financial literacy, and skill building to 200,000 women microcredit borrowers, and 2) have an exclusive NBFC offering financial and business support services to 40,000 enterprises run by women.

In a nutshell: Adith is built upon the premise that access to credit is very necessary, but not sufficient to alleviate poverty alone, and especially for women who face more barriers. It’s certainly a first step, and a strong tool to reduce poverty, but it’s not enough to get women to a place where they are equal and have access to the level of financial capital, services, and skills training that they need to thrive and build wealth. What we NEED is to address gaps in the current system more holistically—through the provision of adequate credit and business support services, and the promotion of entrepreneurship. In fact, Adith is actively working to promote 67,000 entrepreneurs in the next five years, which will directly impact roughly three million beneficiaries. Adith is a shining example of the change that needs to occur—but of course, it’s one company. And for women to truly accumulate wealth, have a seat at the table, and have a voice that’s heard—in other words, for women to gain real power and influence, and become economic contributors—it is imperative that this is not the exception, but the rule.

The Conclusion: Bring Equality to Women, Grow Entire Economies

Microfinance is an important tool to help solve a much bigger issue—but it has limitations currently, and it’s just one part of a greater solution. And all of these elements need to be brought together to create large-scale transformation. This has to do with removing obstacles and ensuring women have access to the capital and resources they need in emerging cities like Chennai—as this will allow them to build a sustainable future in which they can also become much greater contributors to local economies. It not only helps equality for women; it also serves to help societies grow in general. And this has a butterfly effect longer-term that results in a panoply of life-altering and environment-altering situations. Women and girls gain more equality and education. Economies begin to stabilize—or, in some cases, even thrive—which puts them on the world stage and opens trade. Health, and healthcare, is improved because access to capital has expanded to help cover issues and services specific to women—in an affordable manner. The list goes on. And Aananth—through Adith—is working to improve economies around the world, one city and one country at a time.

About Lebec Consulting

Lebec Consulting is a women-led firm that specializes in advising corporations, foundations, high-net-worth individuals, financial institutions, and entrepreneurs on how to achieve their greatest social impact through strategic philanthropy and impact investments. With sustainability, innovation, and systems change at the center of our strategy, we think outside the box and look beyond traditional philanthropy. Our goal is to provide these key stakeholders with the best possible roadmap to achieve impact in ways that will truly reverse the tides of global inequality.